Update for 2016 based on the Lava Magazine bike count data. Previous posts links showing trend data up to 2013, 2014 and 2015 are here:

http://alex-cycle.blogspot.com.au/2013/10/power-meter-usage-on-rise-at-kona.html

http://alex-cycle.blogspot.com.au/2014/10/power-meter-usage-still-on-rise-at-kona.html

http://alex-cycle.blogspot.com.au/2015/10/kona-power-meter-usage-trends-2009-to.html

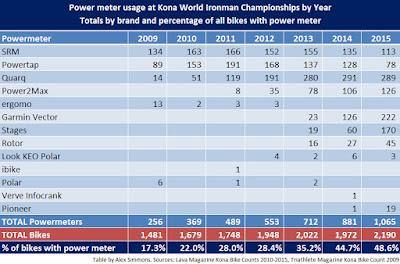

Here are the numbers for 2009 through to 2016 (click on images to see larger versions):

And below is the breakdown showing proportion of bikes with and without power meters, and the split for each power meter as a proportion of all bikes. e.g. the slice of pie for the Powertap is 175 Powertap power meters which is 7.9% of the 2,229 bikes in the the Kona bike count.

2016 continued the long term trend of an increase in use of power meters by Kona IM athletes, and for the first time ever a majority of bikes (57.4%) were fitted with a power meter.

So the pie is getting bigger for all power meter manufacturers. at least as a share of Kona athletes. How indicative these numbers are of broader power meter trends is hard to say.

So how are they all doing as a share of that increasing Kona power meter pie slice?

Below are the year on year trends, ranked by total share of power meters:

Quarq and

Garmin Vector maintained their lead as the most used power meters and like most brands each saw a small increase in their share of the total power meter pie. However their relative share of the bikes fitted with power meters took a hit with Quarq dropping 3.4% to 23.7% and Garmin Vector down 3.0%, to 17.8%. These were the biggest falls in relative share of all the major power meter brands. While this continues Quarq's trend from the previous year of a decline while still maintaining top place, it's a reversal of fortunes for Garmin Vector who showed strong year of year relative share growth last year.

The big mover up the rankings was

Powertap which like most brands improved its share of all bikes but more importantly their share of bikes fitted with a power meter was up 6.4% to 13.7% (nearly doubling their 2015 share). This is no doubt due to the introduction of Powertap's new power meter models, in particular the P1 pedal based meter, which complements their well established hub-based and new C1 chain ring-based power meters.

This reversed the trend in recent years for Powertap, whose numbers were probably a little under represented as the Powertap hub is the one that most likely to be used as a training wheel for some athletes but not as a race day wheel. Unfortunately the Lava Magazine data does not parse the Powertap data into model sub-categories so we can't know exactly the trends for each model, however the pedal count shows 82 bikes with Powertap P1s, which means hubs and chainrings (if any) make up the 93 remaining Powertap models. In 2015 Powertap hubs numbered just 78 units.

Rotor and

Pioneer also saw their share of all bikes and all power meters improve, although from a smaller base.

Stages share of the Kona power meter pie has stabilised after strong growth from 2014 to 2015, with a slight drop in their relative share of power meters.

Power2Max is declining in their relative share of power meters used at Kona and this is the second year they have experienced such a decline.

SRM continues its slow drop in relative share on all bikes and of those fitted with a power meter.

A few new power meter brands make a guest appearance but none have really exploded onto the Kona scene.

Overall observations

These numbers continue the broad trends of previous few years:

i. Power meter usage as a proportion of all bikes used at Kona continues to rise at a rate of nearly 6% year on year. This has been a consistent trend since 2009. If the trend continues, we should expect that in 2017, approximately 63% of all bikes will be fitted with power meters.

ii. Most growth in usage comes from newer power meter models.

For 2016 the majority of growth came from Powertap with 45% of the growth, Rotor 21% and Stages 11%, with the rest making up the remaining quarter of the growth (SRM being the only model with negative growth).

iii. after an initial period of growth, models tend to stabilise their Kona athlete market share for a year or so before beginning a gradual decline in share

iv. no power meter model dominates Kona athlete market share. Quarq maintains its place as the lead choice being fitted to 23.7% of bikes with power meters.

Some caveats:

- obviously this is a sample of athletes that qualified and participated in Kona and hence we can't simply project these trends as necessarily being representative of the overall market.

- the athletes that qualify obviously changes from year to year.

OK, so that's the latest on power meter usage trends from Kona. See you in 2017!

Read More......